Developing a wealth mindset is about changing your perspective on money and success. Regardless of what is in your bank account, having a positive attitude can help you achieve greater financial prosperity. A positive outlook can also keep you open-minded, focused, and ready to conquer your wealth goals.

To cultivate a wealth mindset, you should start by educating yourself about finances and setting clear financial goals. At the same time, be proactive and challenge yourself to move out of your comfort zone. Developing a wealth mindset means spending the time and effort to improve your financial standing. Building greater awareness and confidence, and breaking the process down into steps can lead to a more fruitful and abundant life.

What Is a Wealth Mindset and Why Does It Matter?

A wealth mindset is a set of beliefs, attitudes, and behaviors that have the potential to create and attract financial abundance. A wealth mindset matters because when you have an optimistic outlook for improving your financial situation, the mind can achieve great things. Developing a wealth mindset rarely happens overnight or due to a single miraculous event. Instead, it takes time to create a fundamental shift in perspective and adopt a positive mindset toward money and wealth.

In addition to financial success, a positive attitude may increase the likelihood of attracting success and wealth. One study published in 2022 showed that positive emotions may lead to wealth creation by enhancing cognitive abilities and promoting productive behaviors. The findings also suggest that positive emotions can contribute to wealth by influencing positive life outcomes in work, social relationships, and health. Finally, the authors noted that happier people save more and have less debt.

3 Ways to Cultivate a Wealth Mindset

Understanding what a wealth mindset is is the first step toward becoming a wealthy person. To change your beliefs about wealth and money, you need to shift your focus from scarcity to abundance. This means stepping out of a “poor” mindset that may prevent you from learning new skills and approaching the idea of wealth with an open and flexible mind. The following are three ways to cultivate a wealth mindset.

1. Attend an Abundance Event

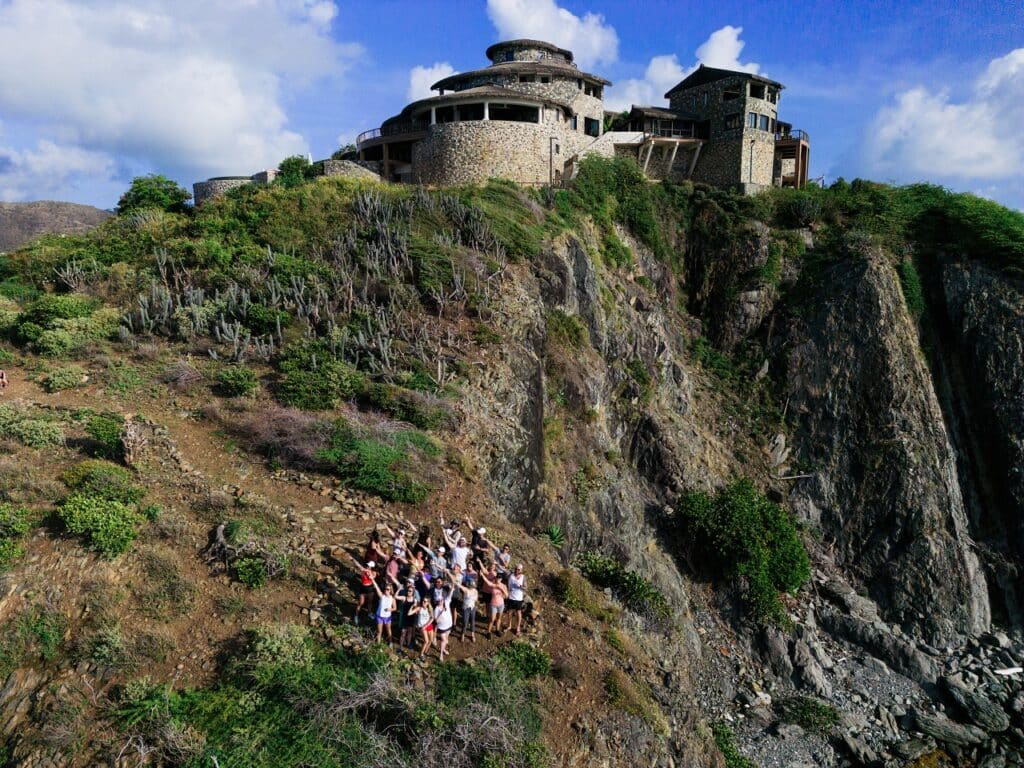

If you are ready to kickstart your life transformation and walk the path of abundance and wealth, attend an abundance event. Abundance events, such as the ones we offer at our private island retreat in the British Virgin Islands, provide an opportunity to learn why the world needs you to be wealthy. In our 5-day Elevate Abundance Summit, you will recognize and abandon the limiting mindset that is holding you back. Then, you will gain the motivation to cultivate diverse prosperity streams and achieve the financial life of which you have always dreamed.

2. Surround Yourself With Successful and Positive People

To cultivate a wealth mindset, surround yourself with people who share your vision for living a positive and successful life. This may mean eliminating or distancing yourself from toxic relationships that impede your ability to reach your true potential. Being in the company of successful and wealthy people can also provide a valuable networking outlet for future collaborations. Similarly, associating with positive and successful people can help you remain inspired and focused on your goals.

3. Create Clear, Measurable Goals

Changing your beliefs is only the first step to creating a wealth mindset. You must then set clear and measurable goals to keep you focused and help you start building wealth. Building wealth happens when you implement positive financial actions such as budgeting, saving, and investing. Each action will take you closer to your financial goals and build momentum. You can set clear and measurable goals using the following prompts:

- Be specific about your goal: One of the reasons people fail to meet their financial goals is because their goals are ambiguous. When coming up with financial goals, be precise. Specific goals could include how much money you want to make each month or particular projects and endeavors you want to invest in. It could also involve implementing healthy habits like saving a set percentage of your monthly income.

- Create measurable goals: When creating financial goals, identify outcomes that can be quantified. This could mean setting sales or income targets and tracking your progress. For example, “By X date, I will earn X amount of money and pay off X amount of debt.” Another example could be “I will create an emergency fund of X amount by X date.”

- Create long-term and short-term goals: Like measurable goals, long-term and short-term goals provide a clear pathway to financial stability. Long-term goals include saving for retirement, purchasing a home, or starting a business. Short-term goals involve building an emergency fund. You need to have a clear vision for both.

- Hold yourself accountable: Wealth accountability involves making informed financial decisions and consistently adjusting your financial habits and goals. Wealth accountability also means taking responsibility for your actions and asking a mentor or a friend to hold you accountable. In your path to financial success, finding someone who keeps you honest and aware of your spending habits can be beneficial.

- Take calculated risks: Creating wealth often involves taking calculated risks and stepping out of your comfort zone. While minimal risk may seem safer, greater gains often come from making wise investments that involve calculated risks. Taking calculated risks doesn’t mean investing in endeavors that could put your financial wealth at risk, especially if you are in debt. Instead, calculated risks are well-thought-out risks that can help you achieve your financial goals faster.

Set Goals, Be Patient, and Persevere

It’s important to be patient as you adjust to new financial thought patterns and habits. You can begin nurturing a wealth mindset by outlining your goals, learning about finances, taking calculated risks, and surrounding yourself with successful people.

Attending a wealth or abundance retreat can also help you achieve your financial vision. However you decide to build financial wealth, each step you take toward your goals will reinforce the belief that you deserve to be financially abundant!